Content

- What is Forecasting?

- How Does a Budget Help Management Make Good Decisions?

- Budget Forecasting and How to Make a Budget Forecast

- What’s the Difference Between a Plan, a Budget, and a Forecast?

- Defining the differences between budgeting and forecasting

- Do I need a budget or a forecast?

- How Do You Prepare a Budget For Your Small Business?

Zero-based budgeting, driver-based budgeting and predictive budgeting can help facilitate and drive your budgeting process, depending on your business demands and the goals you want to achieve. If your business is always evolving, your budgets and forecasts are evolving too.

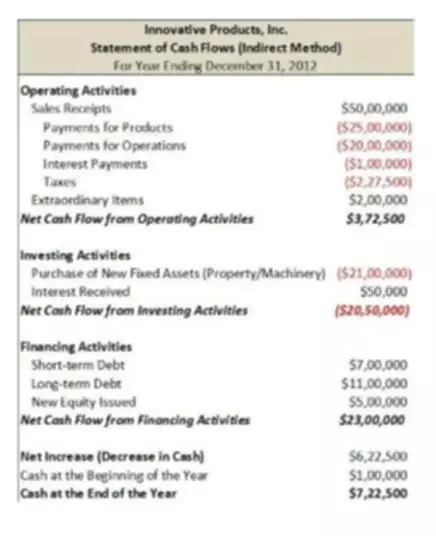

In order to get back on track, you would need to take strategic action to get more new customers. The blue lines on the graphs represent the budget, whereas the green line represents the forecast. On the other hand, since the forecast is used to see whether or not you are on track to hit your budget numbers, you could say the budget comes first. Both serve their own unique purpose and are crucial to building the financial model for your business.

What is Forecasting?

These approaches help managers spot trends before their competitors — helping them make better informed, more agile decisions about pricing, product mix, capital allocations and even staffing levels. Budgetingdetails how the plan will be carried out month to month and covers items such as revenue, expenses, potential cash flow and debt reduction. Traditionally, a company will designate a fiscal year and create a budget for the year.

- Apply those trend calculations to your real-time numbers to come up with forecasted results.

- For the total revenue, you can see that the forecast is trending in the same direction as the budget, but the numbers aren’t quite as high.

- There are also factors such as vendor reliability and support, user community connections and commitment to customer success once the sale is complete.

- Yet, despite the advantages, many businesses avoid rolling forecasts, due to the increased workload it entails in terms of collecting and rolling up data.

- At the same time, forecasting is an interim announcement of the number of rains or sun that can be expected on any given day.

The budget sets detailed spending limits to help achieve the bigger picture forecast goals. This is how the two methods come together to support strong company management. A forecast also helps you react to change in a way that a budget does not.

How Does a Budget Help Management Make Good Decisions?

But in today’s more competitive environment, organizations are realizing that plans, budgets and forecasts need to reflect current reality — not the reality of two, three or more quarters ago. Continuous planning and rolling forecasts are becoming widely used methodologies to update plans, budgets and forecasts frequently throughout the year, on a quarterly or even monthly basis.

- Essentially, expense allowances are built so as not to exceed budget limits, while income projections are the minimum needed to make the budget balanced.

- Uncover variances with automated forecasts and quickly respond to deviations from plan.

- The longer period of time is necessary for making informed decisions.

- Use that as an opportunity to flex your advisory muscles and teach them the difference.

- The forecast may be used for short-term operational considerations, such as adjustments to staffing, inventory levels, and the production plan.

- Download our 2022 survey report for a high-level view of finance team projections and strategies, directly from our CFO.com executive readers.

You can tweak your forecasts on demand with up-to-the-minute numbers, which is helpful in fast-paced business environments where you might need to pivot on the fly. Apply those trend calculations to your real-time numbers to come up with forecasted results. If you know of any variables that could skew your forecast (an upcoming influx of cash, merger, geopolitical conditions, etc.) be sure to account for those when you deliver the forecast to your stakeholders. Key performance metrics are updated based on forecasted numbers, ultimately providing insight into how your business is performing. Employee compensation plans are finalized during the budgeting process. For an annual budget, the process usually takes between three to six months to complete. When constructing the budget for companies, the budget reports may encompass input from the company’s various functional departments and Business units.

Budget Forecasting and How to Make a Budget Forecast

For obvious reasons, you want to know if the two are seriously out of whack. That way you can fix problems before they get too big, and spot opportunities before they’re missed. Plus the exercise will help you get better at estimating https://www.bookstime.com/s and income for the years ahead. Budgeting, planning and forecasting software can be purchased as an off-the-shelf solution or as part of a larger integrated corporate performance management solution. The vast amounts of available data for forecasting created a need for more sophisticated software tools to process it.

What Does Budgeting and Forecasting Software Do?

Budget and forecasting software provides users with a means to collaboratively create budgets and share them across multiple departments. Users can also use Budget and Forecasting software to plan future budgets by incorporating historical data and analytics to predict what resources will be needed.

Because the Budget vs Forecast forecast predicts budgeted values, past data is not directly referred to in this instance. Most budgets typically call for the utilization of historical data and some degree of assumptions.

What’s the Difference Between a Plan, a Budget, and a Forecast?

In a way, the forecast bridges the gap between the business plan and the budget. A forecast is a financial snapshot of the future as it is best understood today. When creating a forecast, teams need to examine possible financial outcomes based on the most up-to-date drivers and assumptions. The result is a view of how the business is trending so that the leaders can determine whether or not adjustments should be made to the existing budgets or plans. Because the future of an organization is undefined, financial planning is a perpetual process.

U.S. on Track to Add $19 Trillion in New Debt Over 10 Years – The New York Times

U.S. on Track to Add $19 Trillion in New Debt Over 10 Years.

Posted: Wed, 15 Feb 2023 19:00:15 GMT [source]

Your budget would help you manage business expenses, while forecasting gives you a good idea of your high-level business goals and the steps you should take to achieve them. Many businesses merge judgment and quantitative forecasting to determine future costs, plan the company’s trajectory, and forecast sales and market demand. A management team can use financial forecasting and take immediate action based on the forecasted data.